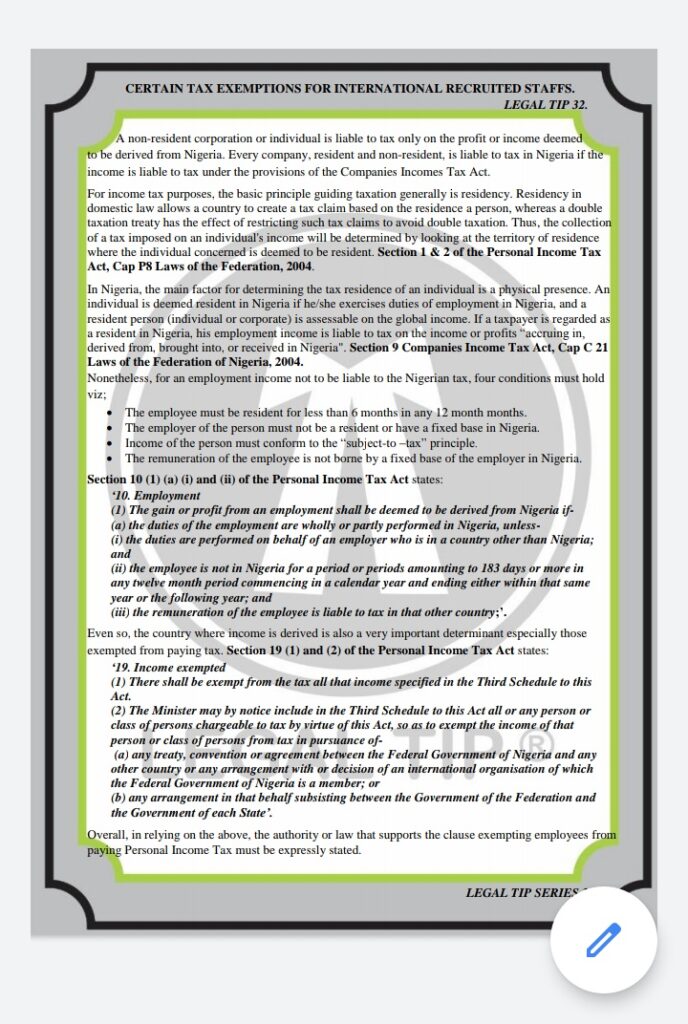

A non-resident corporation or individual is liable to tax only on the profit or income deemed

to be derived from Nigeria. Every company, resident and non-resident, is liable to tax in Nigeria if the income is liable to tax under the provisions of the Companies Incomes Tax Act.

For income tax purposes, the basic principle guiding taxation generally is residency. Residency in domestic law allows a country to create a tax claim based on the residence a person, whereas a double taxation treaty has the effect of restricting such tax claims to avoid double taxation. Thus, the collection of a tax imposed on an individual’s income will be determined by looking at the territory of residence where the individual concerned is deemed to be resident. Section 1 & 2 of the Personal Income Tax Act, Cap P8 Laws of the Federation, 2004.

In Nigeria, the main factor for determining the tax residence of an individual is a physical presence. An individual is deemed resident in Nigeria if he/she exercises duties of employment in Nigeria, and a resident person (individual or corporate) is assessable on the global income. If a taxpayer is regarded as a resident in Nigeria, his employment income is liable to tax on the income or profits “accruing in, derived from, brought into, or received in Nigeria”. Section 9 Companies Income Tax Act, Cap C 21 Laws of the Federation of Nigeria, 2004.

Nonetheless, for an employment income not to be liable to the Nigerian tax, four conditions must hold viz;

• The employee must be resident for less than 6 months in any 12 month months.

• The employer of the person must not be a resident or have a fixed base in Nigeria.

• Income of the person must conform to the “subject-to –tax” principle.

• The remuneration of the employee is not borne by a fixed base of the employer in Nigeria.

Section 10 (1) (a) (i) and (ii) of the Personal Income Tax Act states:

‘10. Employment

(1) The gain or profit from an employment shall be deemed to be derived from Nigeria if-

(a) the duties of the employment are wholly or partly performed in Nigeria, unless-

(i) the duties are performed on behalf of an employer who is in a country other than Nigeria; and

(ii) the employee is not in Nigeria for a period or periods amounting to 183 days or more in any twelve month period commencing in a calendar year and ending either within that same year or the following year; and

(iii) the remuneration of the employee is liable to tax in that other country;

Even so, the country where income is derived is also a very important determinant especially those exempted from paying tax. Section 19 (1) and (2) of the Personal Income Tax Act states:

‘19. Income exempted

(1) There shall be exempt from the tax all that income specified in the Third Schedule to this Act.

(2) The Minister may by notice include in the Third Schedule to this Act all or any person or class of persons chargeable to tax by virtue of this Act, so as to exempt the income of that person or class of persons from tax in pursuance of-

(a) any treaty, convention or agreement between the Federal Government of Nigeria and any other country or any arrangement with or decision of an international organisation of which the Federal Government of Nigeria is a member; or

(b) any arrangement in that behalf subsisting between the Government of the Federation and the Government of each State’.

Overall, in relying on the above, the authority or law that supports the clause exempting employees from paying Personal Income Tax must be expressly stated.